Disclaimer: This article provides general information on UK fintech apps and is not financial advice or a recommendation to buy or use any specific product. Information is based on publicly available data as of June 2025 and may change. Always conduct your own research, understand terms and conditions, and consult a qualified financial advisor for personalized guidance. Investing in financial products, especially crypto, involves risk including potential loss of capital.

Introduction

Fintech is revolutionizing how individuals in the UK manage money. With the cost of living rising and consumers demanding smarter ways to save, invest, and spend, 2025 has seen a surge in feature-rich fintech apps. This guide explores the top fintech apps in the UK, helping you choose the right one based on your financial needs and habits.

The Fintech Revolution in the UK (2025 Context)

The UK remains a global leader in financial innovation, with London as one of the world’s fintech capitals. Consumers in 2025 are increasingly turning to mobile-first solutions that offer personalization, automation, and real-time insights. The Financial Conduct Authority (FCA) ensures these apps meet rigorous standards for consumer safety and transparency.

How We Selected the Top Apps

To maintain transparency and trust, we selected apps based on:

- FCA regulation and compliance

- User reviews (Google Play, App Store)

- Security features (encryption, two-factor authentication)

- Innovative tools for budgeting, saving, investing

- Fee transparency and value for money

- User experience and app interface

Top Fintech Apps in the UK (2025)

Monzo

Purpose: Digital banking and budgeting

Key Features:

- Instant notifications for transactions

- Savings Pots and Budgeting tools

- Fee-free spending abroad

- Business accounts for freelancers/entrepreneurs

Ideal For: Everyday users, budget-conscious individuals, freelancers

Pros:

- Excellent user interface

- Real-time insights

- Strong community support

Cons:

- Premium features behind a paywall

Fee Structure: Free basic plan; Monzo Plus/Monzo Premium for advanced features

Security: FCA-regulated, FSCS protection

Starling Bank

Purpose: Mobile banking with a focus on business and personal finances

Key Features:

- Spaces for savings

- Integrated business banking

- Spending insights and categorization

- No overseas card fees

Ideal For: Small business owners, travelers, savers

Pros:

- 24/7 UK-based support

- Highly rated mobile app

Cons:

- No physical branches

Fee Structure: Free personal and business accounts; fees apply for overdrafts

Security: FCA-regulated, FSCS protection

Visit Starling Bank Official Site

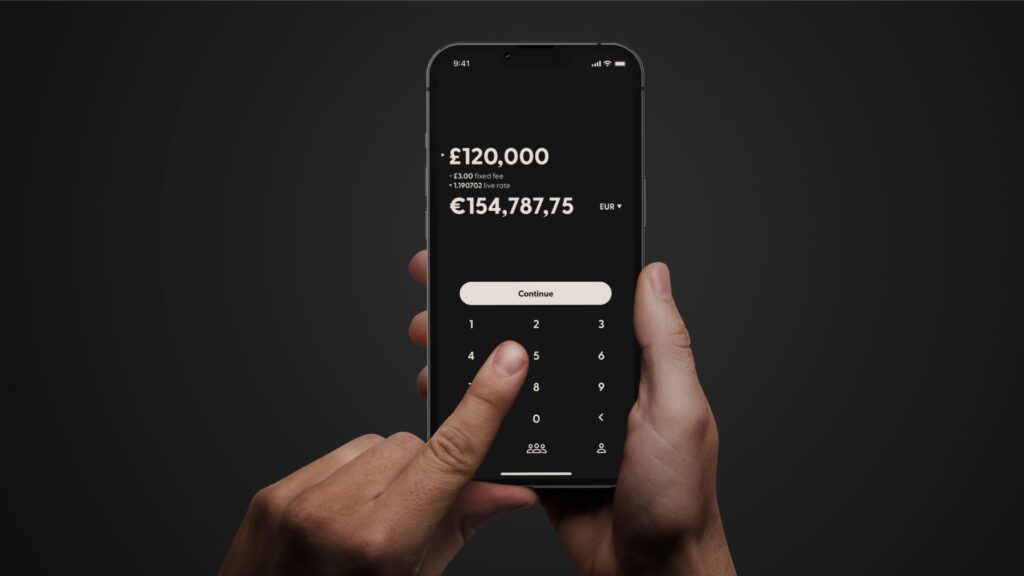

Revolut

Purpose: Global money management, crypto, and investing

Key Features:

- Multi-currency accounts and exchange

- Crypto trading and stock investing

- Instant spending notifications

- Budgeting and analytics

Ideal For: Travelers, crypto users, modern investors

Pros:

- Competitive foreign exchange rates

- Integrated crypto/stocks

Cons:

- Some features restricted to paid plans

- Limited customer service on free tier

Fee Structure: Free plan; Plus, Premium, Metal subscriptions

Security: FCA-regulated (UK), insured balances

Plum

Purpose: Automated saving and investing app

Key Features:

- AI-driven automatic savings

- Investment portfolios (ISAs, pensions)

- Expense tracking and budgeting

Ideal For: Beginners in investing, passive savers

Pros:

- Easy automation

- User-friendly

Cons:

- Investment returns not guaranteed

- Premium tools require subscription

Fee Structure: Free for basic saving; Plum Plus, Pro, Ultra subscriptions

Security: FCA-regulated, uses secure APIs

Emma

Purpose: Budgeting and subscription management

Key Features:

- Account aggregation across banks

- Subscription tracking

- Spending categories and analytics

Ideal For: Budgeters, debt reducers, students

Pros:

- Great UI/UX

- All accounts in one place

Cons:

- Premium plans needed for advanced insights

Fee Structure: Free basic version; Emma Plus/Pro/Super for advanced features

Security: FCA-registered, read-only access to bank data

Chip

Purpose: Saving and investment automation

Key Features:

- Auto-savings based on spending habits

- Investment funds (with risk levels)

- Offers interest on savings with premium tiers

Ideal For: Passive savers, young professionals

Pros:

- Hands-free saving

- Competitive returns

Cons:

- Some savings require paid plans

Fee Structure: Free basic plan; paid tiers offer better returns

Security: FCA-authorised; funds held in segregated accounts

👉 Comparison Table

| App | Key Strengths | Free Tier | Best For |

|---|---|---|---|

| Monzo | Budgeting + Pots | ✔️ | Everyday banking |

| Starling | No FX fees, great for biz | ✔️ | Freelancers, travelers |

| Revolut | Trading + global accounts | ✔️ | Investors, crypto users |

| Plum | Auto-saving + investing | ✔️ | Beginners, passive savers |

| Emma | Spend tracking & insights | ✔️ | Budgeters, students |

Choosing the Right Fintech App for You

When selecting a fintech app, consider:

- What are your goals? (budgeting, investing, saving, travel spending)

- Do you need FSCS protection? (important for banking apps)

- Are you comfortable paying for premium features?

- Do you want everything in one place, or separate tools for different needs?

These questions will help narrow down the best fintech app tailored to your situation.

Staying Safe with Fintech Apps

To protect yourself:

- Only use apps regulated by the Financial Conduct Authority (FCA)

- Enable two-factor authentication

- Avoid apps not listed in the FSCS protection scheme

- Be cautious of phishing emails or fake login screens

Conclusion

Fintech apps have become essential financial tools in 2025. Whether you’re looking to better manage your day-to-day expenses or dip your toes into investing, the UK’s fintech landscape offers something for everyone. Choose the app that fits your needs—and always prioritize security and financial literacy.

About the Author

Jaya is a finance and technology writer with a focus on consumer-friendly reviews, fintech trends, and digital innovation. He is not a certified financial advisor but specializes in creating content based on official sources and factual insights.

Last Updated: June 12, 2025